The concern of Hong Kong employers about the impact of possible economic fluctuations affecting the US, the mainland and Japan is being reflected through salary levels, which stayed steady in the early part of this year.

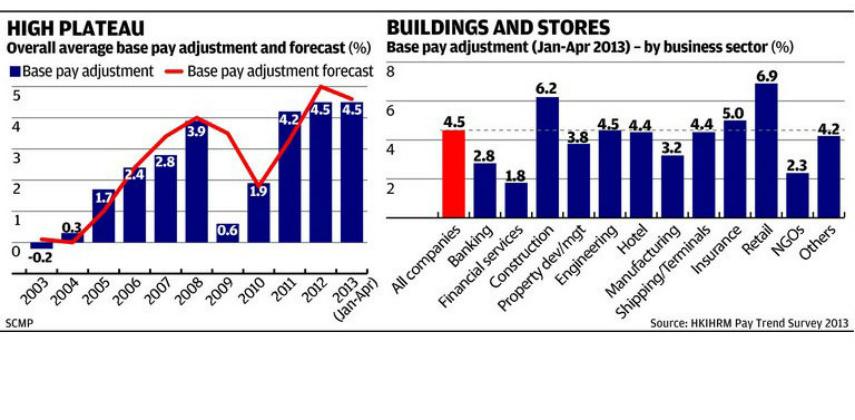

The latest Hong Kong Institute of Human Resource Management (HKIHRM) Pay Trend Survey revealed that the average base pay adjustment in the first four months of 2013 remained positive at 4.5 per cent, with no significant change to overall average bonus payments.

The HKIHRM survey covered 86 companies from 17 sectors, totalling more than 123,000 full-time salaried staff. Of those surveyed, 98 per cent offered an overall base pay rise, compared to 97 per cent in the same period in 2012. The top three sectors offering the highest overall base pay rises were retail, at 6.9 per cent, construction, at 6.2 per cent, and insurance, at 5 per cent.

HKIHRM president Francis Mok says that despite changes in the financial policies of the US, the mainland and Japan, the local economy still performed well in the first quarter of 2013. He also notes that Hong Kong’s unemployment rate remained low at around 3.5 per cent, which may explain why a steady growth in pay was recorded in the survey period.

In the current economic climate, Mok expects that the job market will stay buoyant in the short term, but anticipates that employers operating in flourishing sectors may experience stiff challenges in staff recruitment and retention.

He also believes designing competitive, effective and flexible pay systems will still be a test for bosses and HR professionals. In recent years, however, he has noticed how more Hong Kong companies have adopted such systems based on a pay-for-performance principle.

“Reward strategy is a powerful tool to shape the performance culture of an organisation,” Mok says. To ensure it works, he believes it is necessary to adopt fair and transparent principles. Effective communication on reward principles is also essential to encourage employees to participate in common business goals.

“The decision on pay adjustment for any company boils down to its pay philosophy, current staff pay levels against market benchmarks, affordability, and how its pay is linked to corporate and individual performance,” he adds.

Sharmini Thomas, Michael Page regional director, says that in the financial sector, the pressure on banks to achieve cost savings is prompting employers in general to take a cautious approach when recruiting. For example, prominent firms are using their reputations and brands and offering about a 5 per cent salary increase as an incentive to attract and retain employees. Typically, Thomas says, in boom times, the same organisations offer 15 to 25 per cent.

Thomas has also noted a change in the salary packages offered to financial controllers and internal auditors. “In areas where historically large bonuses were paid, we have seen base rates rise and the bonus component significantly reduced,” she says. She adds that across the finance and financial services sectors, hiring is substantially more robust compared to the finance sectors in many other parts of the world. She says an increase in recruitment activities by mainland financial organisations in Hong Kong is also helping to maintain competitive salary levels.

According to the latest Michael Page salary scale report, over the next 12 months, the average percentage salary rise for finance professionals is likely to be 3 to 5 per cent, although above-average increases may be reserved for senior leadership roles that have a significant impact on the business.

In the retail sector, above-average salary increases are being offered to senior managers with experience at a global or regional level. “It is a real challenge to find enough people to meet demand,” Thomas says.

Additionally, demand for sales and marketing talent with knowledge of digital and social media applications is also putting upward pressure on salaries.

Marc Burrage, regional director of Hays in Hong Kong, believes that designing an effective and flexible pay system is only part of the challenge when it comes to balancing employee expectations with what the employer is able to offer. “Not only are employers focused on cost savings where possible, but an additional challenge comes in that a package consisting of salary alone will not succeed in securing a candidate,” he says.

While employers need to ensure salaries offered are in line with current market rates, Burrage suggests a well-developed benefits, reward and recognition scheme can also be part of a salary package and retention programme.

“As long as there is a fair and equal system for all, ensuring your salaries are in line with current market rates is just one factor in a successful attraction and talent-retention programme,” Burrage says.

He adds that effective performance management remains the key. “Performance reviews are a simple, but essential, process which should take place regularly, with managers committed to the practice,” he says, adding that engagement of staff, defined career pathways, training and development, benefits, and work-life balance initiatives are other important considerations for employers.

Career Advice

Job Market Trend Report

Select article category

Select article category

Career Advice Home

Personal Development and Career path

- Career Doctor

- Career Guidance and Counselling

- English for professional use

- How to Get Promoted

- Job seek in HK

- Plan and start the career path

- Tips to be more productive

- 職場英語 專家教路

How to successed in industry

- Banking and Finance

- Education and Training

- Government and NGO

- Property and Construction

- Startup

Industry Stories, recruitment tips and case study

- Featured stories and job trends

- Legal Case studies for employers

- Recruitment tips

- Successful entrepreneurs’ story

- Successful High flyers’ story

- 職業特搜

Job Market Report, fair and events

- Job fairs and Events

- Job Market Report

- Job Market Trend Report

Select article category

-

Select article category

- Career Doctor

- Career Guidance and Counselling

- English for professional use

- How to Get Promoted

- Job seek in HK

- Plan and start the career path

- Tips to be more productive

- 職場英語 專家教路

Career Advice Home

Personal Development and Career path

- Banking and Finance

- Education and Training

- Government and NGO

- Property and Construction

- Startup

How to successed in industry

- Featured stories and job trends

- Legal Case studies for employers

- Recruitment tips

- Successful entrepreneurs’ story

- Successful High flyers’ story

- 職業特搜

Industry Stories, recruitment tips and case study

- Job fairs and Events

- Job Market Report

- Job Market Trend Report

Job Market Report, fair and events

Pay rises stay steady but bosses wary on hiring

Hong Kong Institute of Human Resource Management (HKIHRM)

,

Pay Trends

,

Survey

,

Michael Page

,

Hays

,

Pay

,

Pay Rise

Other Related Articles

Recommended jobs for you

- Job Posting Enquiry

- + 852 3619 9601 (M-F, 9am - 6pm)

- advertise@cpjobs.com

- General Enquiry

- + 852 3619 9600 (M-F, 9am - 6pm)

- info@cpjobs.com

- Partner with: Classified Post

- + 852 2565 8822 (M-F, 9am - 6pm)

- classified@scmp.com

Copyright © 2025. CPJobs International Limited. All rights reserved