PAY NOW: Retail banking and insurance

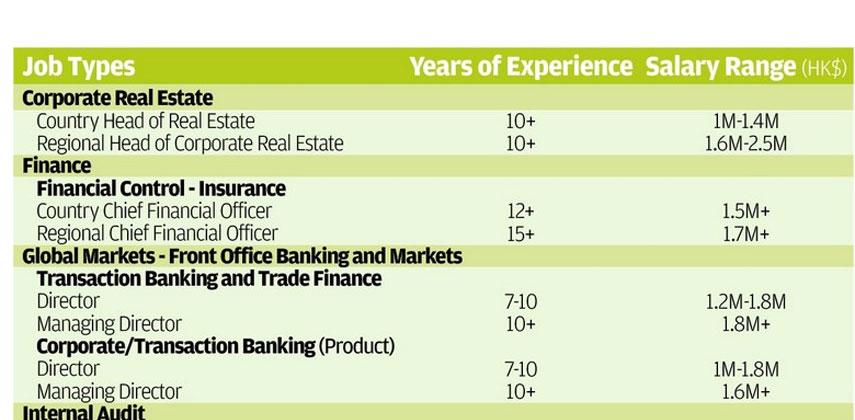

“We have seen significant demand in jobs across all parts of transaction and retail banking. With the margins pushed down and trading volumes are also down on the investment banking side, many banks are going back to the basics of improving transaction-banking business lines, such as currency transfers, cross-border cash and treasury functions, trade finance, and counterparty risk mitigation and security.

“Over the past year, we have noticed many global banks – and indeed Chinese banks – are following suit in hiring across the board from back-office to front-office positions in trade finance. Candidates in demand range from client account managers, client support, products and structuring to trade finance operations, to more control functions like audit, risk, compliance and AML (anti-money laundering). Products specialists with strong exposure to cross-border treasury wire transfers and automated payments have been able to secure good salary increments of at least 25 per cent to 30 per cent on a job move in Asia this year.

“There has been across-the-board growth in the bancassurance market, as well as an increase in activity from mainland insurers. We expect rising vacancies in life insurance businesses. Due to a limited pool of qualified candidates, experienced actuaries are exceptionally in demand.”

“Experienced candidates with Asian languages and an in-depth understanding of the mainland market should also expect pay rises. Those who aim to change jobs seeking greener pastures at this time of year tend to look for salary increments of 25 per cent to 30 per cent – and especially attractive are companies that can offer strong career growth prospects.”

Mark Yeo, Principal Consultant, Harbridge Partners